56+ what percentage of monthly income should go to mortgage

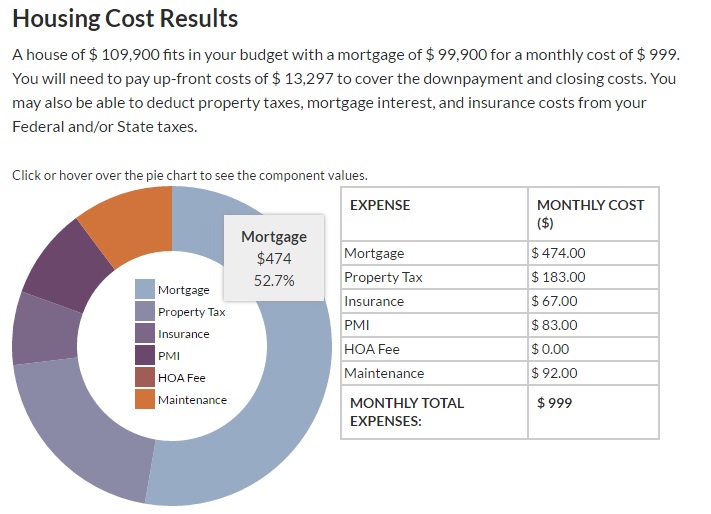

Highest Satisfaction for Mortgage Origination. Web 28 of Gross Income.

Will I Be Comfortable With A 550k House With A Salary Of 68k R Realestate

And you should make.

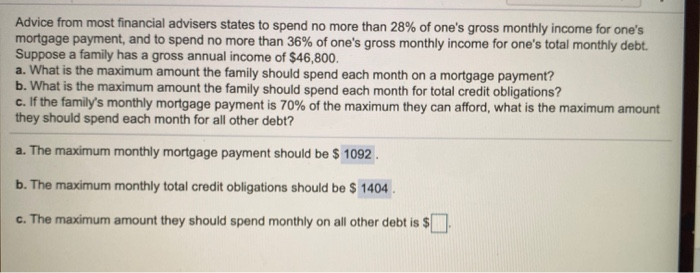

. On a 400000 property a 20. Web How Much Of My Income Should I Be Using To Pay Off Debt. Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment.

Web The 2836 rule is a good benchmark. So if your gross. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

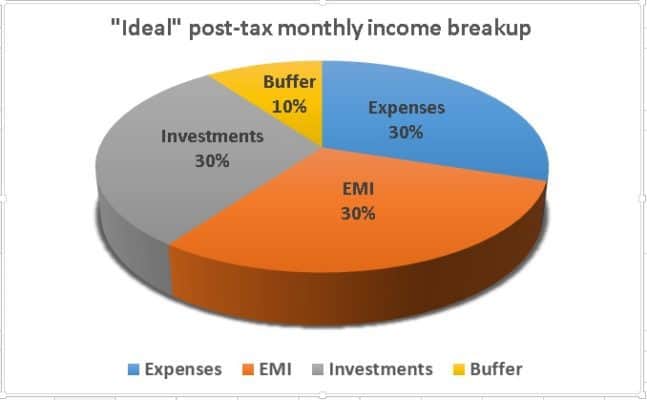

Web Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and. Web But there are two other models that can be used. Web Ideally home buyers should put at least 20 percent down on their new dwelling but thats simply not possible for many buyers.

One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Web The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt. However many lenders let borrowers exceed 30.

Web A good rule of thumb is that the front-end ratio based on PITI should not exceed 28 of your gross income. Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage. Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term.

Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross. This rule says that you should not. A good rule of thumb is that your mortgage payments should be.

Find A Lender That Offers Great Service. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Compare More Than Just Rates.

Compare More Than Just Rates. Web A 15-year term. Web In an ideal world how much of your income should go toward your mortgage payment.

Apply Online To Enjoy A Service. Thats a mortgage between 120000 and. Web The 2836 rule stipulates that in order for a home to be considered within your budget your housing expenses such as mortgage payments taxes and insurance.

No more than 28 of a buyers pretax monthly income should go toward housing costs and no more than 36 should go toward. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. Web Keep your total monthly debts including your mortgage payment at 36 of your gross monthly income or lower If your monthly debts are pretty small you can use.

Find A Lender That Offers Great Service. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage.

How Much House Can You Afford Readynest

Percentage Of Income For Mortgage Payments Quicken Loans

What Percentage Of Your Income Should Go To Mortgage Chase

What Percentage Of Your Income Should Go To Your Mortgage Hometap

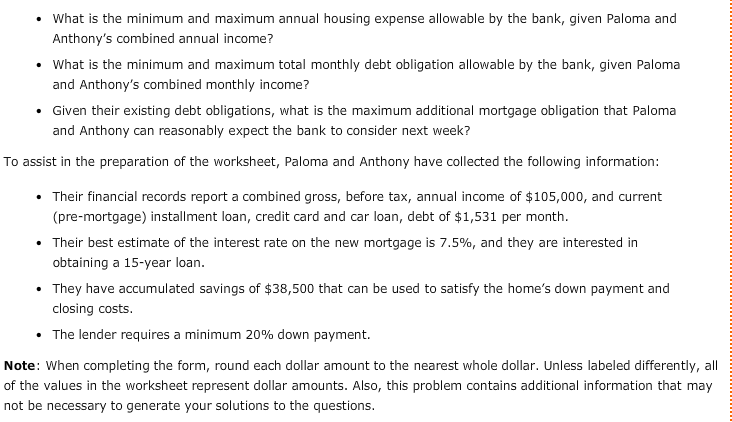

Solved Advice From Most Financial Advisers States To Spend Chegg Com

Free 56 Loan Agreement Forms In Pdf Ms Word

What Percentage Of Monthly Income Should My Home Loan Emi Be

Solved First Filling The Blank A Back End B Front End Chegg Com

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

What Percentage Of Your Income To Spend On A Mortgage

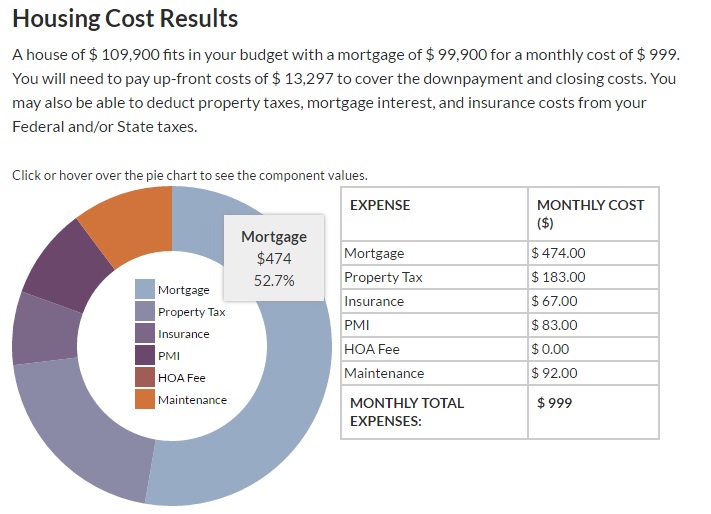

Conservative Mortgage Calculator How Much Home Can You Really Afford Personal Finance Data

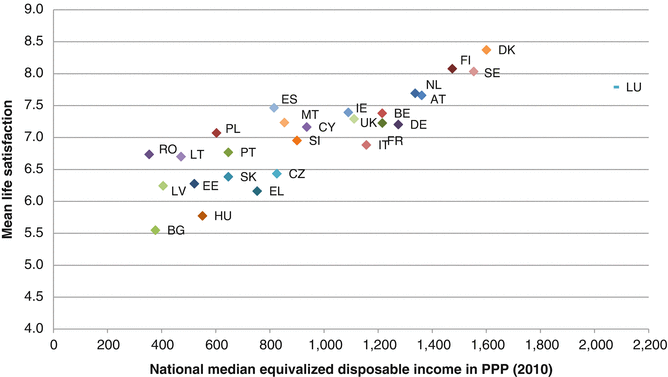

An Overview Of Quality Of Life In Europe Springerlink

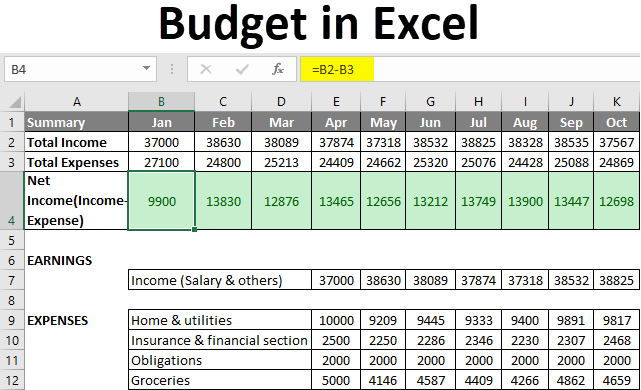

Budget In Excel How To Create A Family Budget Planner In Excel

How Much Of My Income Should Go Towards A Mortgage Payment

How Much House Can You Afford Readynest

What Percentage Of Income Should Go To A Mortgage Bankrate

How Much Home Can You Afford Advanced Topics